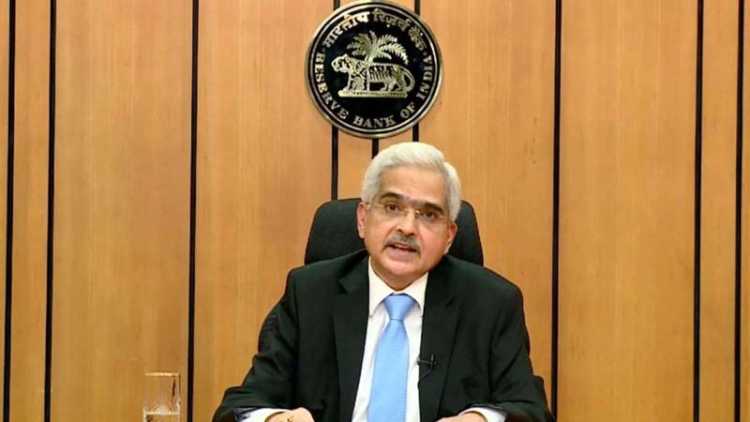

Reserve Bank of India Governor Shaktikanta Das told the media on Friday that the reverse repo rate would be reduced by 25 basis points from 4% to 3.75%, amid the coronavirus crisis that has led to the closure of economic activities following a nationwide lockdown imposed till May 3. The step is aimed at encouraging banks to lend more. The reverse repo rate is the rate at which the central bank borrows funds from commercial banks.

This is the second time the RBI governor addressed the media since the country began the lockdown on March 25. On March 27, the central bank had slashed the repo rate, or the interest rate at which the top bank lends to commercial banks, by 75 basis points to 4.4%. The reverse repo rate was also cut by 90 basis points to 4%. It had also permitted all commercial banks and non-banking financial corporations to allow a three-month moratorium on payment of installments of all term loans.

On Friday, Das added that the central bank has decided to allocate Rs 50,000 crore to small Non-Banking Financial Companies to improve the liquidity position of small and medium enterprises.

Das said the RBI has been proactive and monitoring the economic situation carefully. He said that the RBI’s objectives during the crisis are to maintain liquidity in the system, ease financial stress and enable the formal functioning of markets.

The RBI governor thanked all those who have been at the forefront of the battle against Covid-19, especially entities working in the financial sector. He said that the country’s macroeconomic situation has suffered in some areas during the lockdown, but also improved in some others.

“Global financial markets remain volatile,” Das said. “Crude oil also remains volatile.” However, he added that India is among the few countries in the world whose Gross Domestic Product growth rate estimates remain positive for 2020-’21.

Das cited the International Monetary Fund to say that the global economy is likely to plunge to its lowest depths since the 1929-’33 Great Depression. However, he said, the Indian economy will register a sharp turnaround in the 2021-’22 financial year, registering 7.4% growth.

Das said there should be no worry about industrial output data, which showed 0.1% decline in production for the month of March. He said the data does not capture the impact of Covid-19 on production. Das added that inflation is on a downtrend, as the figures for consumer price inflation for March showed.

The RBI governor claimed that there had been no downtime of mobile or internet banking over the period of the lockdown. “Banks have risen to the occasion by filling ATMs despite logistical challenges,” he added.

Rupee and stock markets

Das’ remarks came a day after the Indian rupee tanked to its lowest ever level against the United States dollar, closing at 76.87. On Thursday morning, it recovered slightly to trade at 76.43 at 10.35 am.

The markets, meanwhile, surged in early trade on Thursday. The BSE Sensex rose 591.60 points to trade at 31,194.21 at 10.37 am. The National Stock Exchange Nifty gained 161.50 points to trade at 9,174.15.

The coronavirus has so far infected 13,387 people in India, and killed 437, according to the Ministry of Health and Family Welfare.